This case was provided by Professor Morton Glantz. Professor Glantz teaches in the finance department of the Fordham Graduate Business School in New York. His books include Optimal Trading Strategies, Managing Bank Risk, Scientific Financial Management, and Loan Management Risk.

Corporate restructuring is to increase sales, increase profits, increase the value of equity, or may be forced to carry out reforms in order to survive when the original corporate governance structure is less efficient. If the restructuring is successful, then management should abandon projects with low yields and high-yielding projects to achieve a shift in production resources from low-yield projects to high-yield projects.

On the one hand, restructuring can be seen as a reform of the company's financial structure; on the other hand, reorganization is an operational approach that is a change in total production, market trends, technology content, and macro disturbances in the industry. Only by recognizing the changes in the surrounding environment and creatively allocating resources can the management grasp the core competitiveness of the company and thus enhance its competitive position. In fact, in order to pursue the company's long-term goals and thus change the operation method and financing structure, this is the most direct way to maximize the value of equity.

For the debt restructuring of banks, the situation is somewhat different. For example, the majority of loans depend on the interest rate and the borrower's ability to repay. A benign loan will be paid in full in time. Banks always want the least cost and the risk-adjusted gains are the biggest. If the borrower's business performance is excellent, then the bank will not be able to participate in the company's profit distribution (at most it can be happy for the company's success). However, if the operating results are not as expected, then the borrower is likely to be unable to repay, then the bank will suffer these pains.

The following two goals tend to be different (especially when borrowers invest their money in overly aggressive projects): credit risk control (which is the bank's goal) and value maximization (the company's pursuit of goals). In traditional credit analysis, there are always many potential risks that are difficult to find. For many projects, bankers often cannot meet both of these goals.

This case study helps improve the analytical skills and communication skills of bankers – enabling senior bankers to effectively deal with transactions and find a balance between risk and return. It is undeniable that the most straightforward way to achieve these goals is to use a random perspective to look at the problem rather than relying on inappropriate judgmental cases or conservative speculation. We have the following basic principles:

The stochastic optimization model allows bankers to feel the fluctuations of random variables more realistically.

When negotiating a restructured loan, the banker and the borrower make decisions based on a stochastic model.

McKinsey & Company believes that a business entity should be divided into a number of smallest functional units to analyze each functional unit.

The basis for evaluating functional units should be a sound financial position rather than a financial report.

When measuring the probability of default, it is necessary to know the volatility of the market and the assets of the borrower.

The company's financial leverage can amplify the volatility of its underlying assets. Therefore, industries with high volatility tend to increase financial leverage, while industries with low volatility tend to reduce financial leverage.

After the optimization and reorganization of the functional units, the evaluation of the functional units and the stable worksheet of the price holder are used together as an assessment of the company's value.

Business Case

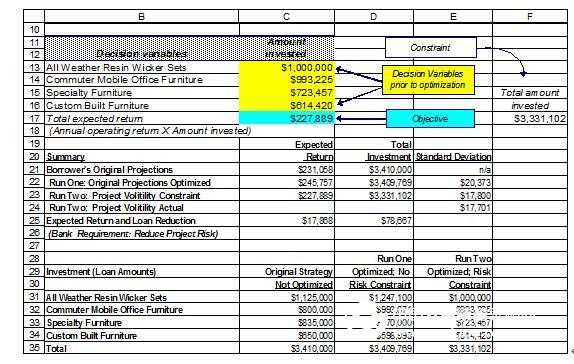

We consider the Excel worksheet shown in Figure 1.1 to Figure 1.3. These worksheets describe the management's initial restructuring plan. Suppose RI Furniture Manufacturing Company makes a $3410,000 loan application to ABC. The management hopes to reorganize the four functional units. In order to obtain a loan, the company provides the bank with the following data: income status, balance sheet, and cash flow.

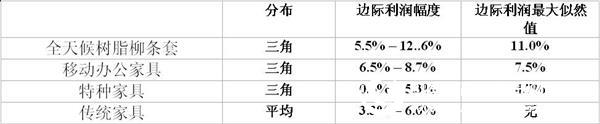

Figure 1.1 Hypothetical distribution

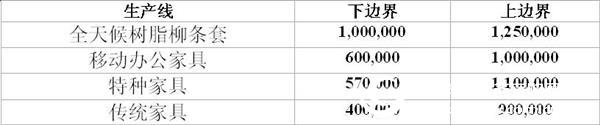

Figure 1.2 Investment boundary

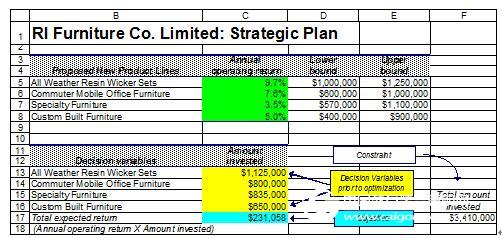

Figure 1.3 The original strategic reorganization plan of the borrower (randomized, not yet optimized)

Static prediction methods make banks tend to narrow the volatility of results. For bankers, if the bank cannot know the probability distribution of possible outcomes, it is difficult for him to know which strategic option the borrower will choose. In fact, an inappropriate restructuring plan may weaken the company's credit rating and increase the risk of default, and we won't let this happen. It is undeniable that this case should be studied in a random way rather than in a decisive way.

Figure 1.3 is a worksheet constructed using random thoughts. This worksheet includes the maximum and minimum investment required for the reorganization of each production line (four in total). Using the deterministic model McKinsey DCF Valuation 2000 Model, we can get a random solution. For functional units, we give the probability distribution of all uncertainty components and reduce the volatility of the cash flow to an acceptable level to maintain the credit rating (also a functional unit level credit rating). Finally, the optimization worksheet is connected to the DCF assessment worksheet. The company then determines the value of the equity, the specific level of confidence, and the probability distribution of the asset less than the liability.

Business history

RI Furniture began operations in 1986. The company has a complete production line for the production of indoor and outdoor furniture. As will be mentioned later, the reorganized functional unit occupies approximately 65% ​​of the integrated business.

All-weather resin wicker cover. This furniture has an aluminum frame and hand-woven branches to protect against weather changes. The distribution of profit and investment amount for each functional unit is shown in Figure 1.1 and Figure 1.3.

Mobile office furniture. This kind of furniture can be installed in a few minutes. It places the computer's external devices (monitor, CPU tower, keyboard, and printer) in a compact, secure environment.

Special furniture. Upon completion of the reorganization, the company will be able to produce furniture at the hotel reception, furniture for the coffee shop, dining room furniture, restaurant seats and dance furniture.

Traditional furniture. The company manufactures traditional style furniture for foreign and domestic customers.

In this case study, the budget constraint for the investment is $3410,000, which means that the loan provided by the bank cannot exceed $3410000. Then we will add other constraints: the volatility of the predictor. According to the information provided in Figure 1.1 and Figure 1.2, we can get the worksheet shown in Figure 1.3.

In the optimization, the constraints of investment and loan are as follows: all-weather resin wicker cover + mobile office furniture + special furniture + traditional furniture ≤ $ 3410000.

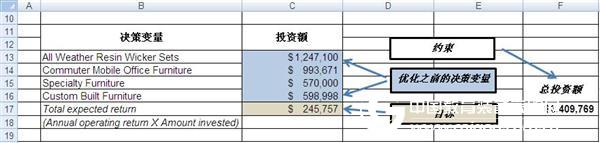

We noticed that the amount of investment is within the constraints and the expected return has increased.

A random simulation shows that the volatility of the expected return is $20000 as measured by the standard deviation. It is important that the volatility of the results of the operations affects the volatility of the assets. Suppose we have determined the value of the company's assets and the volatility of this value. Moody's KMV indicates that the volatility measure is the tendency of asset value to change over a certain period of time. Given the company's liabilities, we can use this information to determine the probability of default. For example, KMV shows that if the value of the current asset is $1.5 million and the company's liability is $750,000 (expired in one year), a default may occur when the value of the asset is less than $750,000 in a year. Therefore, due to prudent considerations, management should run optimization at three levels (as shown in Figure 1.4): (1) maximize expected returns, (2) optimize investment, loan operations, and (3) expectations The volatility of earnings. If the volatility reaches an unacceptable level, then the standard deviation is reduced to maintain the credit rating. We assume that the standard deviation of the item should be less than or equal to $17,800.

Figure 1.4 Results after optimization

Figure 1.5 shows the final simulation results. The loan was reduced (optimized) to $3331102, and financial leverage was improved because less capital was needed. We note that the maximum expected return is $227,889, which is lower than the lower risk of $245757 without volatility constraints.

The story is not over yet. So far, our analysis is limited to the functional unit level. However, the worksheet shown in Figure 1.5 needs to be linked to a worksheet that uses consolidated discounted and comprehensive discounted Discounted Cash-Flow (DCF) models. The comprehensive discount has assessed the strength of the company's future economic trends. The value of RI Furniture is determined by the present value of future cash flows. In other words, the value of a company depends on the potential of cash flow and the risks it faces in cash flow. The risk of cash flow can help us set an appropriate discount rate. Cash flow depends on the sales of RI Furniture's future products, current and future competitive conditions, sustainable competitive advantages, changes in demand and the company's own growth. When measuring risk, the borrower's financial status, financial cash flow volatility, financial leverage, and managerial management capabilities will be considered. Management cannot ignore these important characteristics when making decisions.

Figure 1.5 final optimization results

Simulation and optimization models give intuitive results, and they are powerful weapons for people to observe, analyze, and solve problems.

Food Blenders,Ninja Foodi Blender,Vitamix Food Processor,Blender Food Processor

NINGBO ZHONGJIA ELECTRICAL APPLIANCE CO., LTD. , https://www.foodzhongjia.com